- Back to Home »

- Bank of Brasil Pocket Bank

Banks based in Brazil invested US$ 8.5 billion (R$ 18 billion) in technology last year. The value means 11% of the net assets of financial institutions, according to a study by Getúlio Vargas Foundation (FGV-SP), one of the most renowned business administration colleges in Brazil, in the southeast city of São Paulo. The study shows that banks are the largest investors in information technology in the country.

These expenses were US$ 1.22 billion (R$ 2.58 billion), or 16.7%, greater than those made in the previous year. In 2004, financial institutions in Brazil invested US$ 7.3 billion (R$ 15.4 billion) in technology, 10.5% of net assets. According to the Brazilian Federation of Bank Associations (Febraban), the tendency is for further growth this year.

"Brazilian banks, pioneers in ample use of electronic trade in Brazil, have already identified that the future is in doing business in the digital era," according to the FGV-SP study. Internet Banking and Mobile Banking are some of the areas in which financial institutions are investing.

The FGV's Annual Cost per Keyboard (CAPT) at banks is US$ 22,000 dollars, whereas in the service sector the total is US$ 10,000, in industry, US$ 9,000, and in trade, US$ 6,400. This index is determined by total investment divided by the number of keyboards installed in companies, including terminals at Automatic Teller Machines and cashiers. Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.

Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.

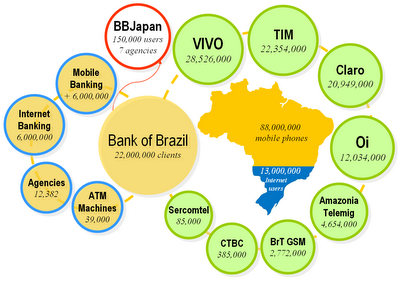

Today, Brazil has an active market of about 88 million cellular devices, in counterpart counts "only" on 13 million people with access to the Internet. What it demonstrates the existence of a very great number of people with capacity to participate of this type technological solution. Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.

Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.

The developer EverSystems is known by the financial area supplying solutions. Responsible for the creation of a mobile banking solution for the Vivo-BB operation, based on the BREW technology , the company now created the new BB version of mobile banking, based on J2ME technology.

The Bank of Brazil has also initiated its operation of pocket bank this week in Japan. The BB will be the first Brazilian financial institution with performance in that country to offer this service to the nipo-Brazilians. The bank has seven agencies in that country, besides keeping partnership with the post offices local for attendance to about 105 a thousand customers in the country. The new service will allow that the customers of the BB also have access its accounts in Japan and in Brazil.

[1] Bank of Brazil (Public, SAO:BBAS3) is the greater retail bank of the Country and possesss currently about 22 million customers. The BB has invested in the magnifying of the forms of attendance by means of electronic channels. With a platform of 39 a thousand terminals spread for the Country, the BB has today a base of 22 million account holders, who carry through 88% of its banking transactions from the auto-attendance service. Internet answers for 36% of the total of these atendances.