Archive for July 2006

Internet Television Broadcasting

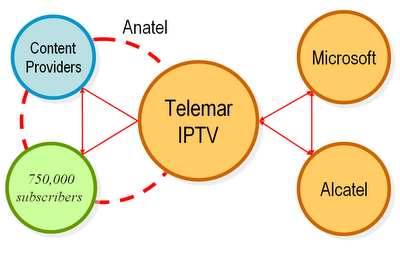

Telemar 1 a private Brazilian telecom operator serving three-quarters of a million subscribers, plans to announce its preferred platform for offering IPTV - Internet Protocol TV (Internet TV) services before the end of August. The operator plans to test IPTV with up to a thousand users this year ahead of a full-blown launch in 2007. It has short-listed three manufacturers to provide it with equipment and although it has not named names, the leading contenders are though to be a joint initiative by French equipment supplier Alcatel and US software giant Microsoft.

Telemar 1 a private Brazilian telecom operator serving three-quarters of a million subscribers, plans to announce its preferred platform for offering IPTV - Internet Protocol TV (Internet TV) services before the end of August. The operator plans to test IPTV with up to a thousand users this year ahead of a full-blown launch in 2007. It has short-listed three manufacturers to provide it with equipment and although it has not named names, the leading contenders are though to be a joint initiative by French equipment supplier Alcatel and US software giant Microsoft.Telefonica de Brasil (Telesp), which passed one million DSL subscribers in 2005, was the first Telefonica subsidiary to launch an RFP (Request for Proposals) for IPTV and a small trial is progressing slowly. And Brasil Telecom, with its 900,000 ADSL lines, has already shown a taste for the video business with its VOD-over-public-Internet service, offering sports, music and lifestyle programming. A number of telcos are working to get the Brazilian government to deregulate video and IPTV market.

Facing increasing competition from mobile phones and the resurgent cable industry, Brazilian fixed operators are getting ready to deploy IPTV. While the challenges for Brazilian IPTV will be numerous, not all is lost of for fixed operators. The primary value proposition of IPTV is as a broadband solution bundled in triple- or quadruple-play packages. The relatively low pay-TV penetration in Brazil therefore represents an opportunity for the country’s operators, who may be able to use IPTV as a catalyst for pay-TV expansion.

IPTV is becoming part of our culture a long time ago before the brazilian government have chosen the japanese DTV digital television system wich is expected to bring the digital television to 92 million recievers spread abroad Brazil´s 8,500,000 sq km.

Brazilian Internet Television has been tested in various ways in the last 4 years (as well by mobile phones operators). There are too many good examples of television services over DSL in Brazil and now it is time to acheive commercial success among broadband subscribers. Websites like Globomediacenter by Globo.com and Bandnews are broadcasting their signal through Internet at DSL speed to the world.

[1] Telemar Norte Leste S.A. (Public, SAO:TMAR5) is engaged in telecommunication services in Brazil. The Company is a specialty provider of local and long-distance landline telephone networks for residential, small business and corporate clients. In addition, it offers international fixed telephony, public telephones, Internet services, videoconferences, image messages and data communications.

Thursday, July 20, 2006

Posted by Fabiano Gallindo

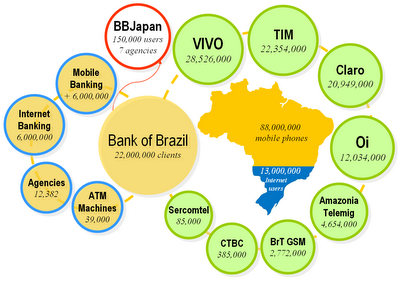

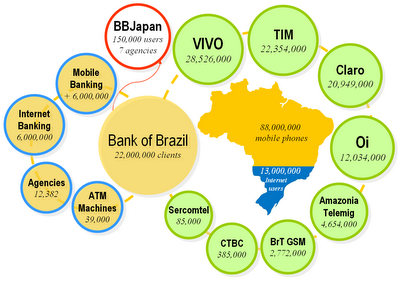

Bank of Brasil Pocket Bank

Banks based in Brazil invested US$ 8.5 billion (R$ 18 billion) in technology last year. The value means 11% of the net assets of financial institutions, according to a study by Getúlio Vargas Foundation (FGV-SP), one of the most renowned business administration colleges in Brazil, in the southeast city of São Paulo. The study shows that banks are the largest investors in information technology in the country.

These expenses were US$ 1.22 billion (R$ 2.58 billion), or 16.7%, greater than those made in the previous year. In 2004, financial institutions in Brazil invested US$ 7.3 billion (R$ 15.4 billion) in technology, 10.5% of net assets. According to the Brazilian Federation of Bank Associations (Febraban), the tendency is for further growth this year.

"Brazilian banks, pioneers in ample use of electronic trade in Brazil, have already identified that the future is in doing business in the digital era," according to the FGV-SP study. Internet Banking and Mobile Banking are some of the areas in which financial institutions are investing.

The FGV's Annual Cost per Keyboard (CAPT) at banks is US$ 22,000 dollars, whereas in the service sector the total is US$ 10,000, in industry, US$ 9,000, and in trade, US$ 6,400. This index is determined by total investment divided by the number of keyboards installed in companies, including terminals at Automatic Teller Machines and cashiers.

Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.

Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.

Today, Brazil has an active market of about 88 million cellular devices, in counterpart counts "only" on 13 million people with access to the Internet. What it demonstrates the existence of a very great number of people with capacity to participate of this type technological solution.

Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.

Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.

The developer EverSystems is known by the financial area supplying solutions. Responsible for the creation of a mobile banking solution for the Vivo-BB operation, based on the BREW technology , the company now created the new BB version of mobile banking, based on J2ME technology.

The Bank of Brazil has also initiated its operation of pocket bank this week in Japan. The BB will be the first Brazilian financial institution with performance in that country to offer this service to the nipo-Brazilians. The bank has seven agencies in that country, besides keeping partnership with the post offices local for attendance to about 105 a thousand customers in the country. The new service will allow that the customers of the BB also have access its accounts in Japan and in Brazil.

[1] Bank of Brazil (Public, SAO:BBAS3) is the greater retail bank of the Country and possesss currently about 22 million customers. The BB has invested in the magnifying of the forms of attendance by means of electronic channels. With a platform of 39 a thousand terminals spread for the Country, the BB has today a base of 22 million account holders, who carry through 88% of its banking transactions from the auto-attendance service. Internet answers for 36% of the total of these atendances.

These expenses were US$ 1.22 billion (R$ 2.58 billion), or 16.7%, greater than those made in the previous year. In 2004, financial institutions in Brazil invested US$ 7.3 billion (R$ 15.4 billion) in technology, 10.5% of net assets. According to the Brazilian Federation of Bank Associations (Febraban), the tendency is for further growth this year.

"Brazilian banks, pioneers in ample use of electronic trade in Brazil, have already identified that the future is in doing business in the digital era," according to the FGV-SP study. Internet Banking and Mobile Banking are some of the areas in which financial institutions are investing.

The FGV's Annual Cost per Keyboard (CAPT) at banks is US$ 22,000 dollars, whereas in the service sector the total is US$ 10,000, in industry, US$ 9,000, and in trade, US$ 6,400. This index is determined by total investment divided by the number of keyboards installed in companies, including terminals at Automatic Teller Machines and cashiers.

Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.

Bank of Brazil1 is revolutionizing the CAPT index launching the 3ª wave of banking attendance in the country. The first wave was to take the customers of the attendance box to be taken care of in ATMs terminals; the second wave was to place the "Internet bank" to the reach of the customers at their homes or offices; now the third wave is to place the "mobile bank" literally in the hands of its customers.Today, Brazil has an active market of about 88 million cellular devices, in counterpart counts "only" on 13 million people with access to the Internet. What it demonstrates the existence of a very great number of people with capacity to participate of this type technological solution.

Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.

Today the BB mobile bank user can make since mere extract and balance consultations until sophisticated transactions as accounts payments, transferences between banks, BB has launched the possibility of the customer to catch an electronic loan and also has an innovation of the Bank of Brazil that is you to catch a consigned loan direct from the mobile device. One another interesting operation is the the prepaid customer is being able to recharge his mobile from the bank account. Today, 26% of almost the 3 million transactions that people carry through in "mobile bank" are related to the user mobile itself. This is a good indication, that the users who are using the solution also are using of daily prepaid and many times do not have access to the Internet.The developer EverSystems is known by the financial area supplying solutions. Responsible for the creation of a mobile banking solution for the Vivo-BB operation, based on the BREW technology , the company now created the new BB version of mobile banking, based on J2ME technology.

The Bank of Brazil has also initiated its operation of pocket bank this week in Japan. The BB will be the first Brazilian financial institution with performance in that country to offer this service to the nipo-Brazilians. The bank has seven agencies in that country, besides keeping partnership with the post offices local for attendance to about 105 a thousand customers in the country. The new service will allow that the customers of the BB also have access its accounts in Japan and in Brazil.

[1] Bank of Brazil (Public, SAO:BBAS3) is the greater retail bank of the Country and possesss currently about 22 million customers. The BB has invested in the magnifying of the forms of attendance by means of electronic channels. With a platform of 39 a thousand terminals spread for the Country, the BB has today a base of 22 million account holders, who carry through 88% of its banking transactions from the auto-attendance service. Internet answers for 36% of the total of these atendances.

Monday, July 10, 2006

Posted by Fabiano Gallindo

Prepaid business model

Prepaid refers to services paid for in advance. Some examples include gift cards, preloaded credit cards, tolls, and cell phone usage credit, among other items.

Prepaid refers to services paid for in advance. Some examples include gift cards, preloaded credit cards, tolls, and cell phone usage credit, among other items.Prepaid phone cards began in the late 1970's in Italy. The purpose was to provide convenient phone calling for travelers and to combat payphone vandalism1. It wasn't until 1992 that the debit phone card began in the US.

Prepaid services and goods are sometimes targeted to marginal customers by retailers. Prepaid options can have substantial cost reductions over postpaid counterparts because they allow customers to monitor and budget usage in advance.

Recent statistics (OECD Communications Outlook 2005) indicate that 40 % of the total mobile phone market in the OECD region consists of prepaid accounts. In some countries, such as Italy, Spain or Mexico, market share of prepaid can be as high as 90 %. In other countries, such as Finland or South Korea, the figure drops to about 2 %.

Recent statistics (OECD Communications Outlook 2005) indicate that 40 % of the total mobile phone market in the OECD region consists of prepaid accounts. In some countries, such as Italy, Spain or Mexico, market share of prepaid can be as high as 90 %. In other countries, such as Finland or South Korea, the figure drops to about 2 %.It seems that after serving well to the mobile phone market on countries like Brazil, Russia, India and China the prepaid card business model is opening the doors to other services.

The first nonphone-card prepaid programs were launched in the mid-1990s by national retailers such as Blockbuster Video and Kmart2. And now with services such as Flexgo (Microsoft), Wi-fi Internet (Velox), Brazilian AICE fixed phone (Anatel) gives their users the opportunity to access a lot of communications services that even in the 21st Century would last another century to be in the hands of low income population if not for those innovative business models.

Another service thought to follow prepaid model is the Ampla one, deliverer of energy services in 66 cities of Rio de Janeiro, who intends to launch this year the prepaid light account. Through a 0800 telephone number, the user goes to determine how much he wants to pay of energy by month. And, by his mobile phone, the user will be advised when his credits would be depleting.

[1] In fact there was a shortage of coins in Italy at the time and payphone theft was common. Cards were introduced with a magnetic strip on the back for use in special phones to combat the coin shortage.

[2] Tom Locke, “Billions in Gift Cards: First Data Plans to Add Loyalty Feature in ’05,” Denver Business Journal, December 10, 2004 print edition.

Sunday, July 02, 2006

Posted by Fabiano Gallindo